Could Venture Debt provided by the European Investment Bank help grow your business further?

European Investment Bank (EIB) Venture Debt is a long-term financing instrument meant to provide significant cash runway in-between financing rounds while minimising dilution of existing owners. This funding allows a company to fully focus on its business after early commercialization and grow to secure stability. It is well suited to fast-growing companies with significant innovation potential and/or to enterprises driven by research and innovation.

European Investment Bank Venture Debt in brief

EIB Venture Debt is primarily a debt financing instrument with equity attributes, with EIB acting as non-controlling investor. It provides long runway and allows for a better valuation for postponed equity rounds.

The ticket size varies between 7.5 – 50 M€ to cover a maximum of 50 % of total investment costs or project budget. Its availability is long – each tranche of the loan is available for up to 30 months from signature. The terms are typically better than those of similar, conventional financing, such as regular venture debt.

Who can apply?

The EIB Venture Debt is open to innovation-driven SMEs that invest heavily in R&D and aggressive international growth. For instance, the companies should be able to demonstrate competence in financial planning and have a clear financial plan for the future. The company interested in applying should already have customers and a scalable product. As seen from the point of view of equity investments, successful applicants are maturing startups of mid-cap companies with minimum of 7.5 M€ equity raised thus far.

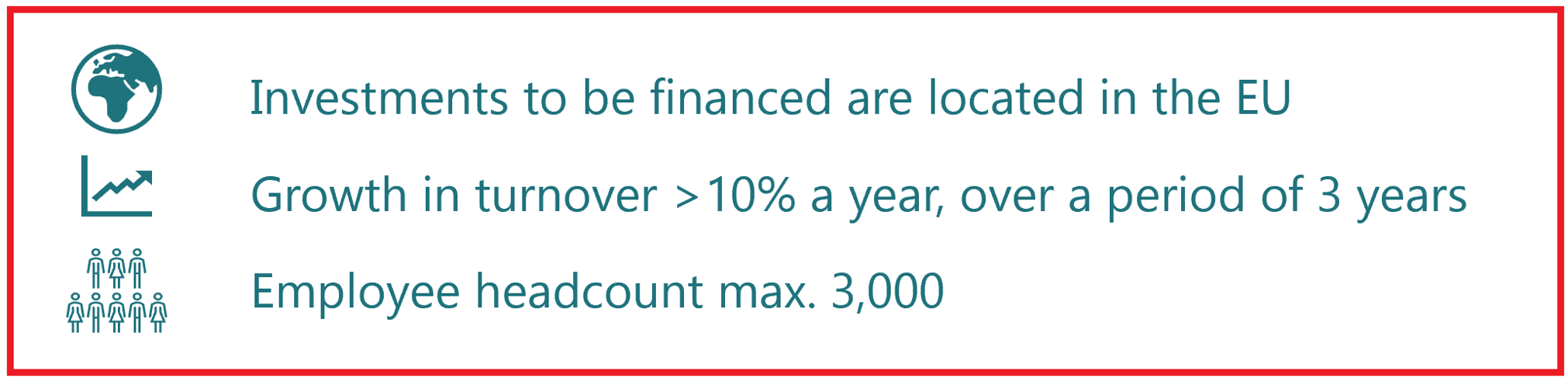

Figure 1. Key requirements for applicant companies.

When is the right time to apply?

In the life span of an enterprise, the company in its early growth or late growth stage that needs financing its growth, a Venture Debt could be an option. In terms of the company’s maturity level, there are no specific Technology Readiness Level (TRL) requirements or limits for applying the EIB Venture Debt. However, the company considering to apply, they should be able to indicate that they

- can scale-up their product from pilot to mass manufacturing

- plan further development of products or services using their in-house R&D

- aim for international expansion.

Would you like to find out in more detail if your company is eligible to boost its growth with EIB Venture Debt? Contact our experts today for a free 30-minute consultation to learn how we can help you!

Janne Kaukojärvi

Consultant, MSc. (Eng.)

Swe: +46 70 844 9760; Fin: +358 50 528 6197

janne.kaukojarvi@spinverse.com